Fully digital identity verification for fast, secure user onboarding.

- ID Document Verification

- ICAO NFC Verification

- Face Liveness

- Face Verification

- Voice Verification

- Voice Anti-Spoofing

- Fingerprints Verification

- Address Verification

- Email Verification

- Mobile Number Verification

- Device Verification

- Handwritten Signature

- Digital Signature

- Video Conference

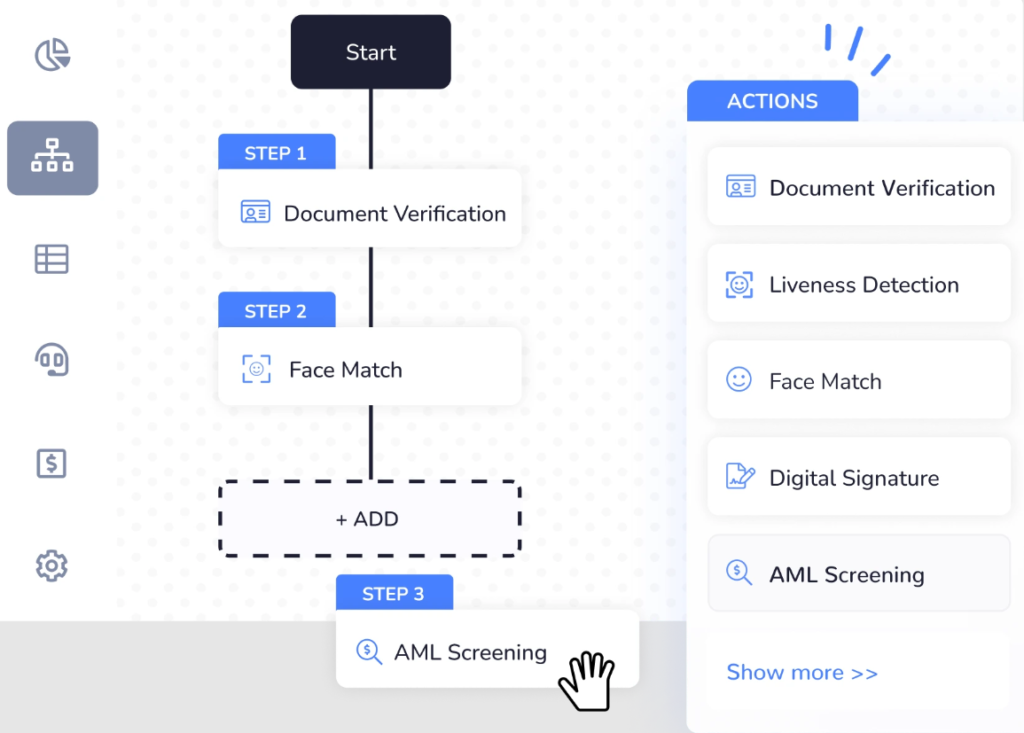

OUR PROCESS

Trust . Security. Compliance. Fraud Prevention

Data Collection

Gather essential user information through a seamless user interface, optimized for both desktop and mobile experiences

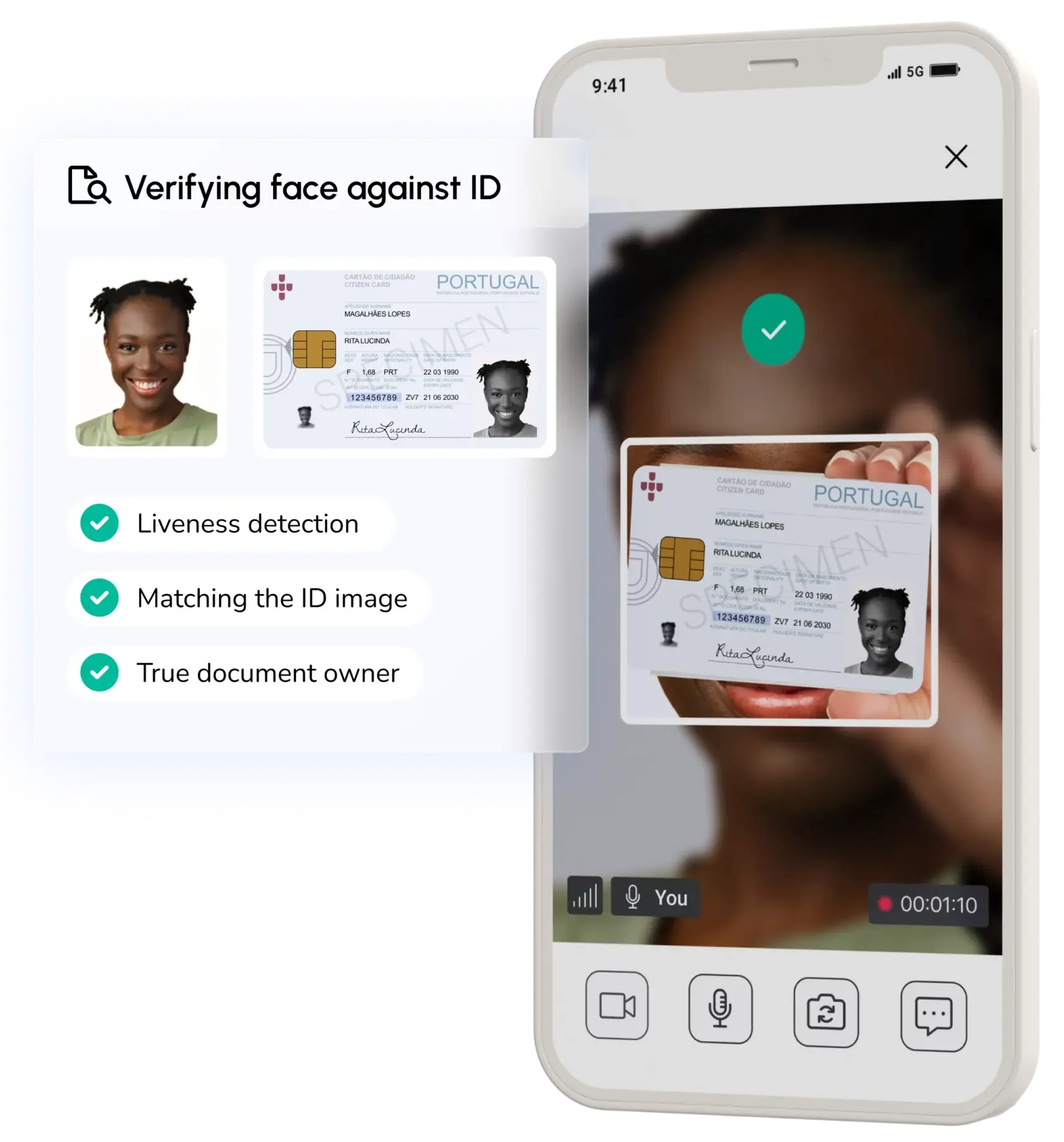

Document Verification

Users can securely upload identity documents such as passports, driving licenses, or utility bills. Our advanced AI-driven technology scans, reads, and verifies these documents in real-time.

Biometric Verification

For added security, we employ cutting-edge facial recognition technology, comparing the user’s live selfie with the photo in their ID document.

Data Cross-Verification

We cross-reference the provided information with trusted databases and data sources globally.

Final Confirmation

Once verified, the user is either granted access or flagged for additional verification, based on the results.

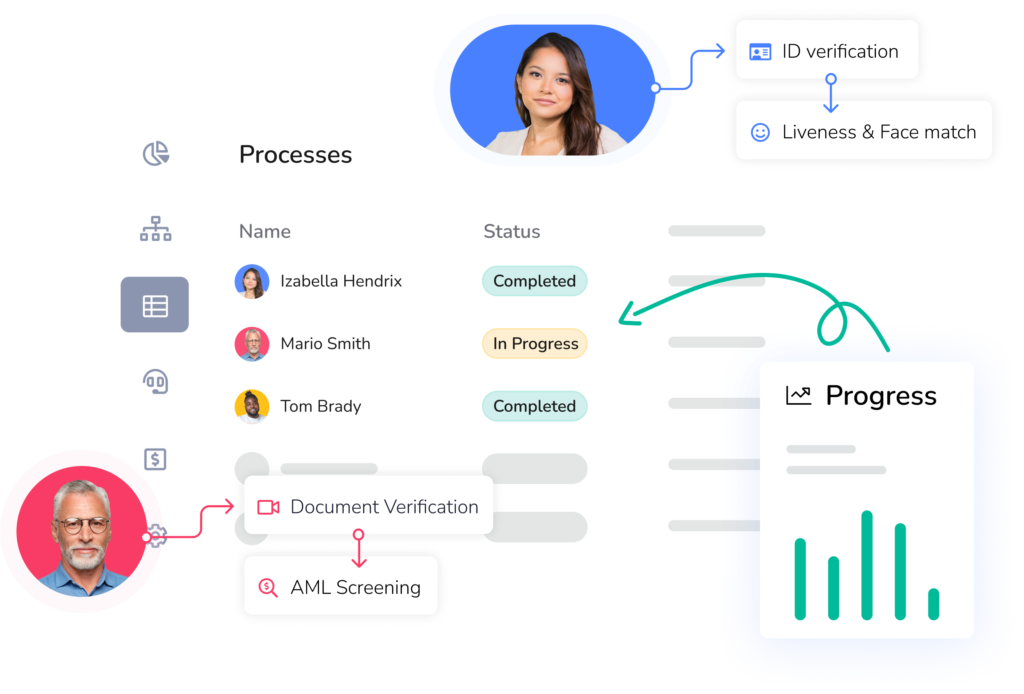

Identity Lifecycle Management

Identity Lifecycle Management (ILM) seamlessly orchestrates the creation, management, and deactivation of identities in a system, ensuring both operational efficiency and security

Key Features

Secure and Compliant

We adhere to global data protection standards, ensuring that user data is handled with the utmost security and respect

User-Friendly

Designed with user experience in mind, making the verification process smooth and hassle-free

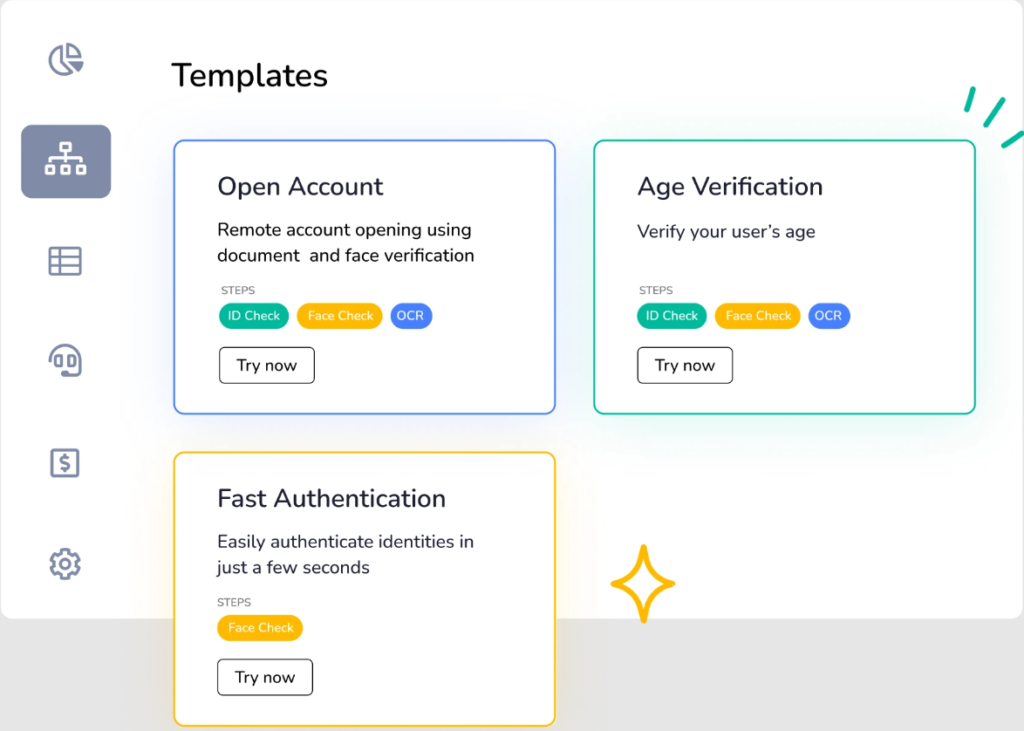

Know Your Customer Deeply (eKYC) Simplified

Our eKYC solution streamlines the Know Your Customer process, ensuring that businesses can trust the digital identities of their customers.

eKYC, or Electronic Know Your Customer, is the digital evolution of the traditional KYC process. It leverages technology to verify the identity of users electronically, reducing the need for physical presence or paper documentation.

- Anti-Money-Laundering (AML)

- Customer Due Diligence (CDD)

- Risk Assessment

- Continuous Monitoring

- Address Verification

- Email Risk

- Mobile Number Risk

- Device Risk

A typical KYC program includes three components: a customer identification program (CIP), customer due diligence (CDD), and continuous monitoring

For organizations looking for an identity verification solution that goes beyond CIP and adds value with CDD, it’s essential to ensure that the vendor can connect to relevant data sources, such as checking identities against sanctions lists. The specific requirements for CDD may vary depending on local regulations. Many identity verification vendors and orchestration solutions now offer this connectivity.

If compliance with KYC and AML regulations is the goal, organizations should be cautious when engaging with vendors offering eKYC solutions. It’s crucial to carefully assess each vendor’s capabilities, given the complex and extensive scope of KYC and AML regulation.

Benefits of eKYC

Reduce customer onboarding times from days to mere minutes

Eliminate the need for physical documentation and manual verification processes

Utilize advanced encryption and cybersecurity measures to protect customer data

Stay aligned with international regulatory standards, adjusting to country-specific requirements with ease

Offer customers a seamless, hassle-free onboarding experience, enhancing satisfaction and loyalty

Our system learns and evolves, continuously improving accuracy and fraud detection capabilities

Capable of verifying a wide range of official documents from numerous countries

Seamlessly integrates with existing systems, ensuring minimal disruptions to current operations

Our eKYC Process

Our eKYC solution streamlines the Know Your Customer process, ensuring that businesses can trust the digital identities of their customers

User Registration

Users provide basic information via a streamlined digital interface.

Document Submission

Customers upload digital copies of identity proofs such as passports, national IDs, or driving licenses

Real-time Verification

Our state-of-the-art AI algorithms scan and authenticate documents against global databases

Biometric Confirmation

Incorporate facial recognition or fingerprint scans to match users with their ID documents for an added layer of verification.

Completion

Post-verification, users receive instant notifications regarding their status, expediting the entire onboarding journey

SAFFEGUARDING FINANCIAL INTEGRITY

Anti Money Laundering (AML)

What is Anti Money Laundering?

Anti Money Laundering refers to a set of procedures, laws, and regulations designed to halt the practice of generating income through illegal actions. By implementing effective AML measures, businesses and financial institutions can prevent and combat attempts to launder money and finance terrorism.

Why AML is Crucial:

- Legal Compliance: Adhering to global and regional AML regulations is not only ethical but also mandatory to avoid severe penalties.

- Protecting Reputation: Being associated with money laundering can severely tarnish a business’s reputation, leading to a loss of trust and clientele.

- Operational Integrity: Implementing robust AML measures ensures smoother, more trustworthy operations and partnerships.

- Economic Health: By combating financial crime, businesses contribute to a more stable and healthy global economy.

In the battle against financial crime, we are your first line of defense.

Trust in our state-of-the-art Anti Money Laundering solutions to shield your operations from illicit activities and ensure you stay on the right side of the law

Our AML Solutions

-

Real-time Transaction Monitoring

Scan and analyze transactions in real time to detect suspicious patterns and activities

-

Customer Due Diligence (CDD)

Vet clients thoroughly before onboarding to understand their financial behaviors and backgrounds

-

Enhanced Due Diligence (EDD)

For high-risk clients, we go a step further, diving deep into their financial activities and connections

-

Risk Assessment

Utilize advanced algorithms to assign risk scores to clients, helping businesses tailor their approach

-

Reporting Tools

Seamlessly generate and file necessary reports, such as Suspicious Activity Reports (SARs), in compliance with regulatory bodies

Key Features

Our system is updated with AML regulations from around the world, ensuring compliance regardless of where you operate

Benefit from machine learning and AI-driven insights to enhance detection accuracy and reduce false positives

Our platform is designed with simplicity in mind, ensuring your teams can easily manage and oversee AML operations

Prioritize data protection with top-tier encryption and cybersecurity measures